In a world flooded with conflicting problems like climate change and ongoing war, humanity now finds itself met with another growing controversy. Will the world’s economy be completely wiped of cashflow upon our globe’s shores? Will this burn a hole in different pockets of society, or could it hold lots of benefits and make complete ‘cents’? The progression of a cashless society feels silent, as adolescents may not notice the closure of a bank, whereas the elderly may hear that shift a little louder. Weighing up the financial benefit of a cashless society will be the objective of this article, alongside a closer look at how the tides are changing in the UK.

Let us begin by diving into what a cashless society is. One may think it is a dumb query to ask; will cash still exist and will it still be seen as legal tender in the years to come? This is not the case. Our forecast projects that countless countries will be cashless by 2045 onwards.

Of course, cash will still be around, but it may disappear from ‘polite society’ and the daily lives of the average person. Even if we have completely moved to biometric methods to complete transactions, like thumb prints, cash will still exist. It will just be irrelevant. Count Zero, a book written by William Gibson in 1995 follows a man in an upcoming future that quotes “It wasn’t actually illegal to have (cash), it was just that no one actually did anything legitimate with it.” Although the book is a mere prediction of the way things may go, it puts forth the notion that cash will still be around but will find underground importance rather than living on the surface habiting are wallets and pockets. David Birch, a global commentator on digital and financial services said in a Forbes article: “This is a plausible vision of the not-too-distant future.”

Cash will still be legal tender but may just not matter as the UK heads towards digital transactions only. Photo – Daniel Tandy

“Cash? People only get cash out for drugs nowadays” quoted by a group of students from University of Leeds when interviewed about the use of cash today. This speaks on behalf of a generation who have grown up alongside mobile phones and debit cards, however this would be a total contrast in the way older generations have been brought up, meaning their view on the importance of cash may be distinctively different. Having said that, let us look at some of the pros and cons of a cashless society.

For many living in an ever-growing digital world, being cashless is simply more convenient. If a person has their card at hand, they have immediate access to all their cash holdings. Even without a card, the effortless way in which people can add a card to their phone and rest ironically above a cash reader to make payment, is what makes digital transactions practical and timesaving. This saves people the trouble of wondering how much money they should take with them, leading onto the next point. Crime rates…

With cards being freezable, many can be seen carrying their card in their phone case making them visible to criminals. Photo – Daniel Tandy

Walking around with physical cash could make you more vulnerable or valuable to a thief. If money has been taken from your wallet, then the chances of tracking it and proving it as your own are very slim.

The rise in use of biometrics holds lots of advantages in preventing crime in a cashless society: individual physical and behavioral characteristics personal to you are measured making fraud a much smaller risk. Advancements like embedded microchips, Near Field Communication technology, Address Verification, digital wallets, and even artificial intelligence payment systems will be acting as digital doormen to your finances, protecting cashless payments.

With the increase of contactless payments, it seems cash tips are much harder to come by in hospitality. Photo – Daniel Tandy

Despite this being alien to an older generation, vulnerabilities they face such as infectious diseases ,like Corona virus, are considerably harder to be passed on with the use of non-contact payments. Dirty money by ‘Serhan Cevik’ states although there is no unambiguous evidence on the transmission Covid 19 had through cash, the attitude towards risk linked with the use of bank notes and coins is enough for courteous behavioral changes.

When travelling you may need to exchange your cash for local currencies, however if you happen to be going to a country which had already taken a cashless approach the impending predicament of predicting your exact holiday spendings goes out the window. For travelers, this next point may raise some interest, foreign ATM’s may also charge a higher exchange rate than if you were to simply double tap that convenient apple pay button on your phone, which converts your money to their currency in seconds.

Physical exchanges have been a fundamental part of society, all starting back in 1000BC, when the Chinese imitated cowry shells out of bronze and copper as thus created the first ever form of currency. So, it is important to note that these ‘benefits’ of a cashless society may only hold value towards those that have not relied on cash or physical exchange as a means of getting by from an early age. It may not have been precedent to Gen Zs for instance to use physical money in their daily lives hence why the advantages of a cashless society to them may be apparent. Whereas for the older generations this rips them away from what they know, stripping them of a sense of familiarity and comfort.

Nationwide branch staff said: “Majority of people who come in are elderly with some exceptions of mums and students who need help balancing finance.” Photo – Daniel Tandy

Cashless transactions will unlikely be beneficial to everyone: the Access to Cash report, published prior to the pandemic in 2019, one in five UK nationals could be forgotten in the move to a cashless society. Elderly people may find the likes of online banking a challenge as they have not been brought up with it, unlike the tech savvy children of today who take it for granted.

One may be lured into overspending through the ease of cashless transactions. Simply, physical cash that you can hold and take out your wallet or pocket to purchase something could help give spenders more notice to how much money they are using, opposed to income-ing debt that tapping, swiping and clicking may have on careless consumers. New budgeting methods may need to be formulated.

Criminals may be after your physical cash, but the birth of cyberthief’s means one’s digital currency could also be at risk. The worry of sophisticated hackers exploiting your online details is very real, especially those who are vulnerable like elderly people or young children. The Economist covered a huge hacking incident where a sole hacker managed to steal 107 million people’s details from Capital One bank in a matter of days. This was an astute invasion of millions of people’s data that even the most discerning could fall victim to.

Not only would online information be in danger from hackers, but democratic collapse in a country could mean those deemed as ‘responsible’ could take advantage of your information. For instance, if you were living in a society which shifted from a secure democratic outlook to protecting consumer information, you may be ok. A society, however, where the government wants to keep closer tabs on what people are doing to get control, means personal details could be exploited for intrusive gain. An increase in surveillance: digital transactions can be recorded by governments, therefore is easier for them to track individuals‘ spending activity. In an undemocratic ruling system, this could be used to control dissenting voices and political opposition.

In a world where phones listen to us to target us with personalised advertisement and algorithms on apps like Instagram and TikTok constantly analysing our usage patterns, it feels like online anonymity is like trying to find a viral video with no views. Cash transactions offer a degree of anonymity and privacy that digital payments do not. Often internet users now rely on VPNs to avoid their internet activity being tracked, so using cash will let them hold on to some privacy still. Although cashless transactions seem convenient, they are accompanied by little spies who follow you around the web that come in the form of delicious ‘cookies’. Like these sweet agents of the internet, if a democratic government crumbles, the loss of cash may pave way for online payments facing snoopy government scrutiny providing them with even more means for control over the public.

NatWest branches promise customers they will have open branches for a few years to come. Photo – Daniel Tandy

Those who are ‘unbanked’ in today’s world and cannot get access to a bank, are therefore excluded from any gain of a cashless society. According to Britannica, these could be deemed as ‘poorer’ people potentially referring to members of society like the homeless or those who are out of prison. A paperless system could essentially exacerbate social inequality as those from poorer or marginalised communities may not have any way of accessing the digital world of payment.

TSB branch in Leeds projected to close in upcoming years. Photo – Daniel Tandy

There is a wealth of arguments for and against a cashless society, but you can bet your bottom dollar that it’s fast approaching either way. GBN (Britain’s News Channel) reported that the number of bank branches that have closed since 2015 has exceeded 6000 after analysis from ‘Which?’. TSB have now confirmed 36 of it’s branches will cease operations from September 2024 to May 2025. Other banks which will be following suit in the next upcoming months include Barclays, NatWest and Royal Bank of Scotland.

Jenny Ross, Which?’s money editor explained: “while many are making the switch to online banking, it would be wrong to assume that banks are no longer required or wanted by millions of customers who use it to manage increasingly tight household budgets during the ‘cost of living crisis’.” Figures from UK finance stated in 2021, 23.1 million consumers used cash once a month or not at all in comparison to 13.7 million the previous year. The number of cash payments decreased by 1.7% to 6 billion, while remaining the second most common form of payment, making up 15% of all payments made in the UK in 2022. There is no doubt with cash becoming even less popular these figures may have increased to even fewer spenders using cash.

Contactless payments jumped up by 36% from 2020 to 2021 and were responsible for a third of UK payments made. 58% of card payments were made via contactless. The way in which people could use contactless expanded when the limit you could pay went from £45 in 2020, to £100 in 2021. Today in 2024, Apple Pay has no limit at all, meaning consumers can use their mobile to make any contactless purchase at any price.

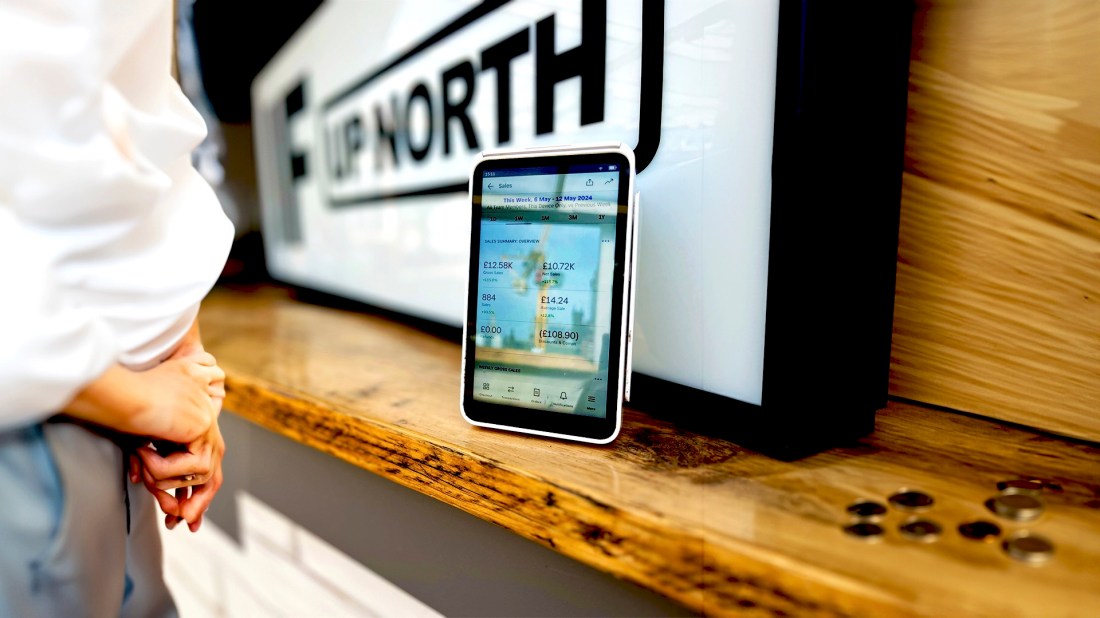

With contactless payments increasing substantially each year, will there be a need for cash? Photo – Daniel Tandy

Adrian Buckle, Head of research at UK finance said: “Cash usage fell slightly, although remained the second most commonly used payment method. These are trends we expect to continue over the next decade, alongside a continued decline in cheque use, and an increase in the number of people using remote banking.”

Norway, Sweden and Finland are leading the way of cashing out on a society which uses physical currency. The majority of Sweden’s bank branches are no longer handling cash, while most restaurants and shops only accepting card or mobile payments. The UK will follow the footprints of Sweden by being predominately cashless by 2045 according to UTP group.

The opening of ‘banking hubs’ by major high street banks – in ties with the Post Office – will welcome an answer for those who still want to manage their money at a branch. Furthermore, the Financial Conduct Authority (FCA) has planned new rules so that people can still get acess to cash by ensuring banks still provide ATMs. This has been partially added to UK government law from 2023. Moreover, the FCA has been bestowed powers to make sure most people will have access to a free ATM within a mile from their home or three miles for people from rural areas.

Andrew Griffin, Secretary to the Treasury said: “Cash still has an important role to play. That’s why we are taking action to protect access to cash in law and laying out that this means fee-free withdrawals and the availability of cash facilities within a reasonable distance.”

A cashless society feels imminent for the UK with other countries having progressed already to a completely paperless system. A gradual but profound change which will impact government, business and individuals across the world. Unmatched convenience, fraud reduction, security and more are just some of the benefits to heading to a cashless society. Undoubtedly, there will be drawbacks like digital exclusion and cyber security.

The use of Cash in the UK is depreciating every single year. Photo – Daniel Tandy

Our world of commerce is changing whether we like it or not. Will a cashless society sow together the stitches to greater transparency and convenience? Or will our material world crumble as we go from contactless to contact-less as AI send our grandchildren a digital ‘10 credits for your birthday!’ instead of a card and a £10 note.

You must be logged in to post a comment.